Cash in time is an online innovative factoring solution founded in 2017 by Crédit Agricole Leasing & Factoring. The concept is simple: a professional can transfer a customer invoice online to get a payment within 24 hours. In just a few minutes, he or she registers to the platform to submit the invoice and check whether it can be financed by Cash in Time. If it is the case, the total is paid within 24 hours to the account.

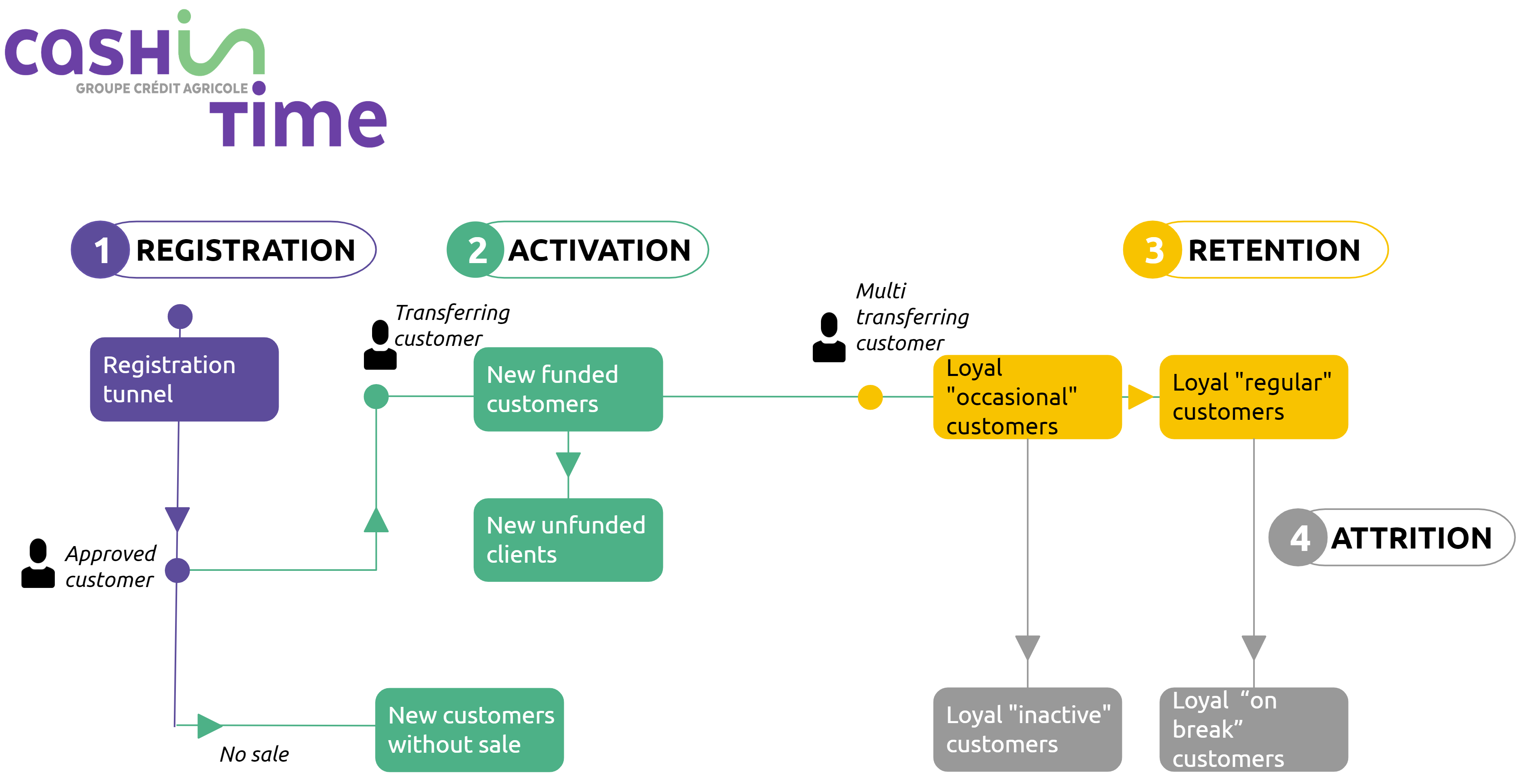

As Cash in Time is a non-binding offer, loyalty is a major issue for the viability of the business model for Crédit Agricole Group.

Convinced that a personalised loyalty programme will reduce the attrition rate, Cash in Time called on Numberly to study the data that has been collected (nominative and behavioural). The challenge was to determine the key moments in the life cycle and to carry out a segmentation of customers, according to their sector of activity for example, and to establish targeting recommendations.